Carbon Offset Marketplaces Explained

Karel Maly

September 16, 2025

Think of a carbon offset marketplace as a specialised online shop, but instead of buying a new pair of shoes, you're investing in verified climate action. These digital platforms are where businesses and individuals can find and fund environmental projects to balance out their own carbon emissions. They’re the essential link connecting people who want to neutralise their carbon footprint with the project developers making a real difference on the ground.

Understanding The Role Of Carbon Offset Marketplaces

At their heart, these marketplaces exist to make climate action transparent and accessible for everyone. They act as a critical bridge. On one side, you have companies that have done the hard work of calculating their unavoidable emissions. On the other, you have project developers all over the world who need funding for their climate-positive work.

But these platforms are much more than just a place to process transactions; they are carefully curated catalogues of environmental impact. The "product" on the shelf is a carbon credit. Each credit is a certified, tradeable unit representing one tonne of CO₂ (or its equivalent) that has been either prevented from entering the atmosphere or actively removed from it.

The Key Players Involved

To really get your head around how these marketplaces work, it helps to know who the main players are:

- Project Developers: These are the people and organisations doing the work. They could be planting trees, building wind farms, or capturing methane from landfills. They are the "producers" of the carbon credits.

- Verification Bodies: Think of these as independent, third-party auditors. They rigorously check that the emission reductions claimed by a project are real, measurable, and permanent. They provide the quality control that gives the market its credibility.

- Registries: These are the official bookkeepers. Big names like Verra and Gold Standard issue the carbon credits and track them from creation to "retirement" (the point where a credit is used and taken out of circulation), which prevents double-counting.

- Buyers: This is anyone from an individual wanting to offset a flight to a large corporation working towards its net-zero goals.

Why Marketplaces Are Essential

Imagine trying to find, vet, and fund a high-quality carbon offset project on your own. It would be a nightmare for most of us. Marketplaces solve this problem by gathering projects in one place, standardising the information, and creating a trusted environment for the transactions. They bring order to what would otherwise be a messy and confusing system.

As more people care about the environmental impact of their purchases, understanding this process becomes even more relevant. A report on the carbon neutral hand soap market, for instance, shows how even everyday products are tied into these bigger climate actions, often made possible by credits bought through these very marketplaces.

A carbon offset marketplace democratises climate finance. It allows a company in Prague or an individual in Brno to directly support a verified rainforest protection project in the Amazon, ensuring their contribution has a tangible, certified impact.

This structure allows money to flow directly to effective climate solutions anywhere in the world, making it a powerful tool in our global fight against climate change.

Key Carbon Offsetting Concepts at a Glance

Navigating the carbon market means getting familiar with some specific terminology. It can seem a bit dense at first, but the core ideas are straightforward.

This table breaks down the fundamental concepts you'll come across.

| Concept | Simple Explanation | Its Role in the Marketplace |

|---|---|---|

| Carbon Credit | A certificate representing one tonne of CO₂ that has been reduced or removed from the atmosphere. | The "product" being bought and sold on the marketplace. |

| Verification | An independent audit to confirm a project's climate claims are real, measurable, and permanent. | Ensures the quality and integrity of the credits available for purchase. |

| Registry | An official database that issues, tracks, and retires carbon credits to prevent double-counting. | Acts as the central ledger, providing transparency and trust for all transactions. |

| Retirement | The final step where a carbon credit is permanently taken out of circulation after being used by a buyer to offset their emissions. | Proves that the offset has been officially claimed and cannot be resold or used again. |

Understanding these terms is the first step to confidently engaging with carbon markets and making informed decisions about which projects to support.

The Journey of a Carbon Credit: From Project to Impact

When you buy a carbon offset, you’re not just clicking a button. You're stepping into the final chapter of a long and carefully managed story. Every single carbon credit has a life of its own, starting at a project site somewhere in the world and ending when it’s retired in your name. To really get what makes a good offset, you need to understand this journey.

The whole process is built to make sure every credit stands for one genuine, verified, and unique tonne of CO₂ that's been taken out of the atmosphere or prevented from entering it. This rigorous lifecycle is what stops things like double-counting and ensures your contribution makes a real difference. It turns a concept into a measurable climate action.

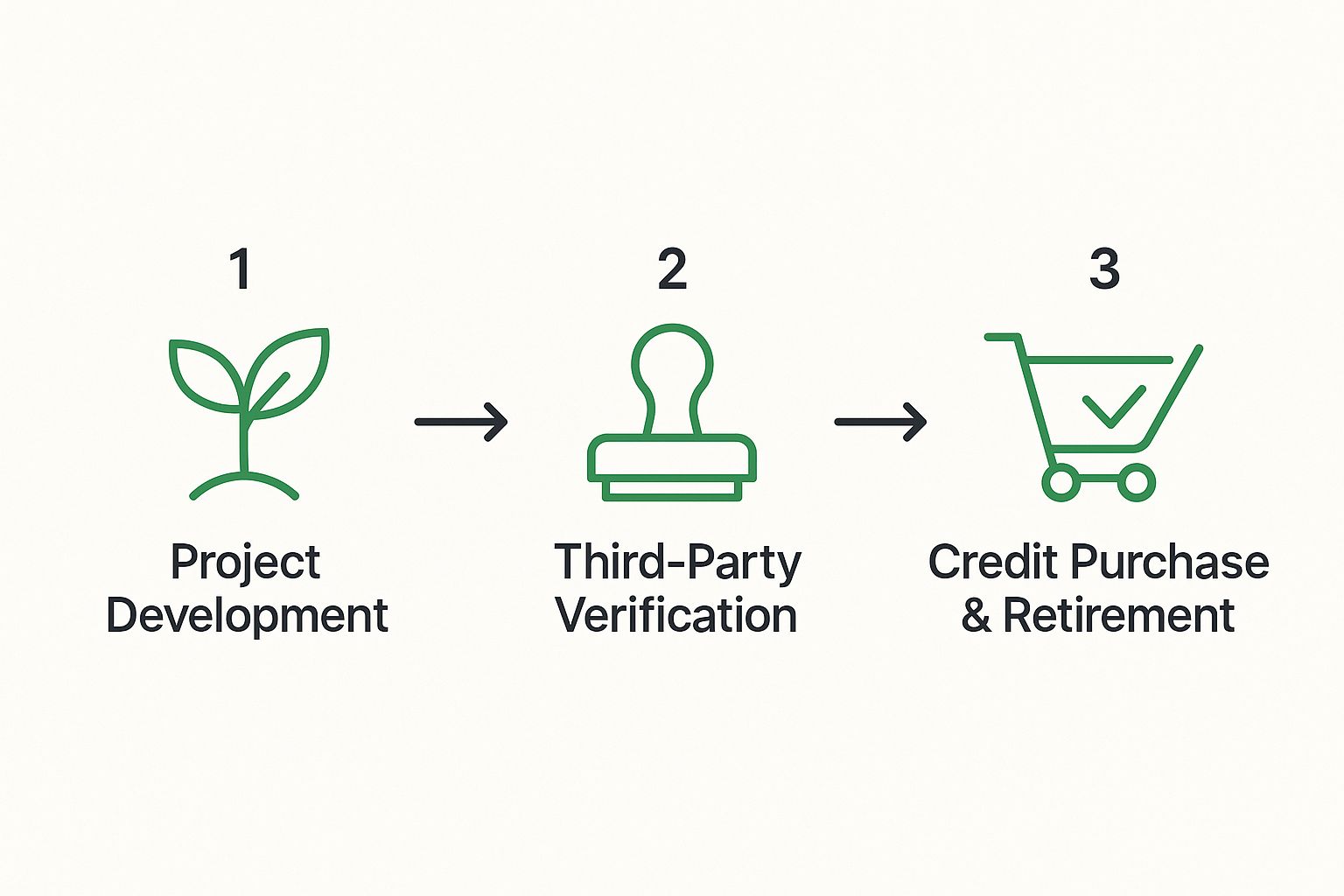

This flow chart breaks down the essential stages a carbon credit moves through, from its birth in a climate project to its final retirement.

As you can see, a credit's journey is anchored in solid development, independent checks, and a secure transaction, all to guarantee its environmental claim holds up.

Step 1: It All Starts with a Project

Everything begins on the ground with a project developer. This could be anyone from a non-profit replanting a forest in Latin America to an engineering firm setting up a wind farm in rural Europe. Their goal is the same: design a project that will actively reduce greenhouse gases.

This isn't a weekend project. It involves serious planning, feasibility studies, and getting the green light from local communities and authorities. Critically, the developer has to establish a baseline—a clear picture of what emissions would have looked like without the project. This baseline is the yardstick against which all future climate benefits are measured.

Step 2: Constant Monitoring and an Independent Audit

Once the project is up and running, the real work begins. Its performance is tracked constantly and meticulously according to a strict monitoring plan. For a forestry project, that might mean teams are out there measuring tree growth. For a renewable energy project, it’s about logging every kilowatt-hour of clean energy produced.

All this data is then handed over to an accredited, independent third-party verifier. Think of them as a financial auditor, but for carbon. Their job is to pore over the numbers and visit the site to confirm that the emission reductions are real, accurate, and meet global standards.

This verification step is the bedrock of a credible carbon credit. Without it, a credit is just an unproven claim. It provides the assurance that one credit truly equals one tonne of CO₂ reduced.

Step 3: Getting the Official Stamp from a Registry

After the verifier signs off, their report goes to a recognised carbon registry, like Verra or Gold Standard. The registry acts as the official bookkeeper. They review all the paperwork and, if it all checks out, they issue the carbon credits. Each credit gets a unique serial number, like a vehicle identification number, and is logged in a public database.

This system creates a transparent, traceable record. Anyone can look up a credit by its serial number to see where it came from, what kind of project generated it, and its current status. It’s all about accountability.

Step 4: Your Turn – Purchase and Retirement

This is where you come in. Using a carbon offset marketplace, you can find projects that resonate with you and buy credits to meet your sustainability targets. For businesses, this usually comes after a deep dive into their own operational emissions. If you’re not sure where to start, you can use tools like Carbonpunk's free carbon footprint calculator to get a solid estimate.

Once you buy a credit, the most important thing happens: retirement. The marketplace tells the registry to take that credit’s serial number out of circulation for good. It's now officially "used" and can never be sold or claimed again. This is your proof of impact—the final, definitive link between your purchase and a verified climate benefit.

Exploring Different Types of Carbon Offset Projects

When you start browsing a carbon offset marketplace, you’ll quickly see that not all climate projects are the same. There’s a whole spectrum of initiatives out there, each one tackling the climate crisis from a slightly different angle. Getting to grips with these differences is the first step in choosing projects that genuinely align with your company’s values and sustainability goals.

Think of it like building an investment portfolio. You wouldn’t put all your money into one type of stock, would you? A smart strategy involves diversification. The same logic applies here. A strong offsetting strategy often means supporting a mix of project types, each bringing its own unique strengths and benefits to the table.

At the highest level, we can group these projects into two main camps. The first is focused on stopping greenhouse gases from ever getting into the atmosphere. The second is all about actively pulling existing carbon out of the air. Both are absolutely vital, and the best carbon offset marketplaces will always offer a healthy mix of the two.

Emission Avoidance Projects

Emission avoidance projects are essentially about stopping pollution at the source. They work by swapping out a high-emitting activity for a much cleaner, greener alternative. These projects prevent emissions that would have otherwise happened, making them a really proactive way to take climate action.

Here are a few of the most common types you’ll come across:

- Renewable Energy: This is a classic. These projects fund the construction and operation of wind farms, solar parks, or hydroelectric dams. By pumping clean electricity into the grid, they reduce the need for fossil fuels, preventing countless tonnes of CO₂ from being released.

- Methane Capture: Methane is a seriously potent greenhouse gas – over 80 times more powerful than CO₂ in the short term. Projects at landfills or on large farms capture this gas before it escapes. It’s then either converted into electricity or flared, which turns it into the less harmful CO₂.

- Efficient Cookstoves: In many developing communities, cooking happens over open fires or on basic stoves that burn wood inefficiently. This creates a lot of emissions. By providing clean, efficient cookstoves, these projects cut down on fuel consumption and carbon output, while also dramatically improving indoor air quality and people’s health.

The rise of these projects is a huge driver behind the growth of the global carbon offsetting market, which is on track to hit US$52.266 billion by 2030. This is particularly relevant for countries like the Czech Republic, which are becoming more involved in both voluntary and compliance-based carbon schemes. You can find more detailed insights on the carbon offsetting market's growth on Knowledge Sourcing Intelligence.

Carbon Removal and Sequestration Projects

While avoiding new emissions is crucial, we still have to deal with all the carbon that’s already up there. That’s where carbon removal projects, often called sequestration projects, come in. Their entire job is to capture and store CO₂, effectively pulling it out of the atmosphere for the long haul.

Carbon removal is like cleaning up a spill that’s already happened, whereas emission avoidance is about preventing the spill in the first place. A complete climate strategy needs both.

These projects often lean heavily on nature and can deliver powerful co-benefits that go way beyond just the carbon maths.

The Power of Nature-Based Solutions

Some of the most popular and intuitive carbon removal projects fall under the umbrella of nature-based solutions. They simply harness the power of natural ecosystems to do what they do best: absorb and store carbon.

- Reforestation and Afforestation: Reforestation means planting trees in areas that have been cleared, bringing a forest back to life. Afforestation is about planting a brand-new forest where there wasn’t one before. As these trees grow, they suck CO₂ out of the air and lock it away in their trunks, roots, and the soil.

- Improved Forest Management: This is all about protecting the forests we still have from being cut down or degraded. By using sustainable management techniques, these projects keep vital carbon sinks healthy and intact, preventing the massive release of stored carbon that comes with deforestation.

- Regenerative Agriculture: This is a game-changer for farming. Practices like planting cover crops, reducing how much the soil is tilled, and rotating grazing animals help rebuild organic matter in the soil. This doesn't just make the soil healthier and crops more resilient; it turns the farmland itself into a massive carbon sink.

Ultimately, choosing between these project types isn’t about finding one "best" option. It’s about understanding the unique impact each one has and building a portfolio that shows a real, deep commitment to a healthier planet.

Understanding Vetting Standards and Certifications

In any market, trust is everything. But when it comes to carbon offsets, that trust isn’t just about the money changing hands—it’s about the environmental integrity of the entire system. Without a rock-solid way to verify the claims being made, the market is vulnerable to "greenwashing," where offsets look great on paper but do nothing to help the climate.

This is precisely why independent vetting standards and certifications exist. Think of them as the quality control inspectors of the carbon world. These are third-party organisations that have built incredibly detailed rulebooks (or methodologies) to scrutinise carbon offset projects. Their stamp of approval is the best guarantee a buyer has that one carbon credit really does represent one tonne of CO₂ that has been genuinely and permanently removed or avoided.

These standards provide the essential framework that separates real climate action from hollow promises. They ensure every credit sold on a reputable platform has been thoroughly examined, giving you the confidence that your investment is making a measurable difference.

The Pillars of a High-Quality Carbon Credit

When a certification body like Verra or Gold Standard looks at a project, they aren't just counting trees. They're testing the project against a handful of core principles that are the bedrock of a high-quality offset. Getting your head around these pillars is the key to telling a credible credit from a questionable one.

- Additionality: This is the absolute golden rule. A project is only "additional" if the emissions reductions would not have happened without the revenue from selling carbon credits. It answers the crucial question: did my purchase actually make this climate-positive action possible?

- Permanence: The climate benefit has to stick around for the long haul. For a reforestation project, this means putting strong safeguards in place to ensure the forest won't simply be cut down in a few years, which would release all that captured carbon right back into the atmosphere.

- No Double Counting: Each carbon credit must be one-of-a-kind and officially "retired" once it's used. This is why registries that issue unique serial numbers for every credit are so important—they ensure that one tonne of reduced CO₂ is only ever claimed by one buyer.

- Leakage Prevention: A good project can't just shift the problem somewhere else. For instance, protecting one patch of forest isn't very effective if it just pushes logging operations into an unprotected area right next door. This is known as "leakage," and good methodologies are designed to prevent it.

Introducing the Major Global Standards

While a few different standards exist, a couple of major players really set the bar in the voluntary carbon market. When you see their name on a project, you can be sure it has gone through a demanding, multi-stage review.

These certification bodies act as the gatekeepers of quality. Their rigorous, science-based methodologies are designed to ensure that one carbon credit truly represents one tonne of real, permanent, and verified emissions reduction.

Let's take a look at how some of the most prominent standards stack up.

Comparing Major Carbon Credit Standards

The table below gives a high-level comparison of the most recognised international standards you'll encounter when exploring carbon offset projects. Each has a slightly different focus, but all are committed to ensuring environmental integrity.

| Standard | Key Focus Areas | Common Project Types |

|---|---|---|

| Verified Carbon Standard (VCS) by Verra | The world's most widely used standard, known for its robust methodologies across a vast range of sectors. Focuses heavily on GHG accounting integrity. | Reforestation, avoided deforestation (REDD+), renewable energy (wind, solar), methane capture from landfills. |

| Gold Standard | Renowned for its dual focus on climate impact and sustainable development. Projects must deliver verifiable benefits to local communities. | Clean cookstoves, water purification projects, community-based renewable energy, sustainable agriculture. |

| Climate Action Reserve (CAR) | A leading standard in the North American market, known for its high-quality, conservative protocols and transparent registry. | Forest management, ozone-depleting substance destruction, landfill gas capture, livestock methane projects. |

| American Carbon Registry (ACR) | The world's first private voluntary GHG registry, with a strong scientific underpinning and pioneering methodologies. | A wide array, including complex industrial projects, improved forest management, and agricultural innovations. |

While each standard has its own niche, their shared goal is to build a trustworthy and effective market. Advances in technology, particularly in monitoring, reporting, and verification (MRV), are making these standards more reliable than ever. Innovations like satellite imagery and blockchain are also adding new layers of security and transparency to the process, as noted by industry analysts like Polaris Market Research in their carbon credit market report.

Understanding these standards isn't just for buying offsets; it's a vital part of corporate sustainability reporting. For businesses looking to dive deeper into accounting for their emissions, it's worth reading our guide on how to achieve ISO 14067 compliance for measuring a product's carbon footprint. These frameworks provide the essential layer of trust that makes carbon marketplaces a powerful and reliable tool for climate action.

Navigating the Challenges and Criticisms

While carbon offset marketplaces offer a promising way to fund climate action, they're not a silver bullet. The market is full of complexities and potential pitfalls, and it’s crucial to understand these issues to make smart, high-impact decisions. Acknowledging the criticisms head-on is the only way to separate the good projects from the bad.

One of the loudest and most valid criticisms is greenwashing. This is when a company buys cheap, questionable offsets to slap a "green" label on their brand, all while doing very little to reduce their own emissions. Offsetting can become a convenient way to justify business-as-usual pollution.

That's why any credible climate strategy has a golden rule: reduce your own emissions first. Offsetting should only come into play for the unavoidable emissions that are left over after you've genuinely cleaned up your own house.

The Problem of Proving Impact

Beyond greenwashing, there's the thorny issue of proving that a project actually works. One of the biggest concepts to get your head around is additionality – basically, proving the climate-friendly action wouldn't have happened without the money from the offset. For instance, was that forest really going to be cut down, or was it protected anyway? Proving this is notoriously difficult.

Then there's the problem of permanence. What happens if the forest you paid to plant burns down in a wildfire ten years from now? All that stored carbon goes straight back into the atmosphere. Good projects have plans for these kinds of risks, but for nature-based projects, it's a constant challenge.

A carbon credit’s value is directly tied to its integrity. If its additionality, permanence, or verification is in doubt, its environmental claim collapses, undermining the trust that the entire market is built on.

This is precisely why you can't cut corners on certification. Sticking to projects verified by globally recognised standards is the only way to be sure you're not just throwing money away on a good story.

Market Volatility and Operational Hurdles

The financial side of things can be just as tricky. The market is known for its volatile carbon credit prices and ever-changing regulations. Compliance costs can also be steep, particularly for businesses in heavy-emitting industries.

For smaller companies without a team of carbon trading experts, these hurdles can feel insurmountable. This complexity often makes it harder for them to invest in the very low-carbon technologies they need. You can read more about some of these issues in the Czech Republic carbon market challenges on 6wresearch.

It all comes down to this: navigating carbon offset marketplaces explained effectively requires more than just good intentions. It demands serious due diligence and a real commitment to transparency.

By understanding these criticisms, you can ask the right questions and demand a higher standard from everyone involved. This critical eye doesn't undermine the market; it makes it stronger, pushing the whole industry towards better quality and real accountability. That’s how we ensure every pound spent makes a genuine difference.

How to Choose the Right Carbon Offset Marketplace

The voluntary carbon market is booming, and new platforms are popping up everywhere. While it's great to have options, it can also feel overwhelming. Picking a marketplace isn't just about buying a credit; it’s a public statement about your organisation's commitment to real, impactful climate action.

To make the right choice, you have to look past the slick marketing and headline prices. What really matters are the fundamentals: transparency, the quality of the projects, and how easy the platform is to use. A little homework now ensures your investment truly supports credible climate solutions and lines up with your sustainability goals.

Key Evaluation Criteria for Marketplaces

Before you sign up for anything, it’s worth running each platform through a consistent checklist. This will help you cut through the noise and find a marketplace that offers both integrity and genuine value.

Think of your evaluation in three main parts:

-

Project Vetting and Transparency: How deep do they go when checking their projects? You should see a clear, upfront commitment to globally recognised standards like Verra and Gold Standard. The marketplace must provide easy access to all the crucial documents, like verification reports and direct links to the official registry. No excuses.

-

User Experience and Tools: Is the platform actually usable? A good marketplace lets you search, filter, and compare projects without a headache. The best ones give you a clean dashboard and simple portfolio tools to manage and track your offsets from start to finish.

-

Pricing and Fee Structure: You need total clarity on costs. Are there hidden transaction fees lurking in the small print? How do they calculate the price per tonne? Trustworthy platforms are always upfront about their pricing.

Focusing on Reporting and Integration

For any serious business, buying an offset is just the first step. The real work often comes later with reporting. Solid, detailed reporting is absolutely essential for compliance, keeping stakeholders informed, and guiding your internal strategy. The marketplace you choose should let you download clear reports showing exactly which credits you bought and, crucially, when they were retired.

The best platforms get that offsetting is just one piece of a much larger carbon management puzzle. They build features that don't just handle the sale but also provide the data and insights you need for complete, auditable ESG reporting.

This reporting capability is often what separates the good from the great. As you look at different options, ask yourself how easily their data will plug into your own systems. To dive deeper into this, you can explore the best carbon offset reporting platform options in our detailed guide. Getting this right can save your team hundreds of hours and prevent the nightmare of manual data wrangling.

Ultimately, choosing the right marketplace means finding a true partner—one that supports your entire climate strategy, from the initial purchase right through to your public disclosures.

Frequently Asked Questions

As carbon offsetting moves from a niche topic to a mainstream business practice, it's only natural that questions come up. Getting your head around the details of how these markets work is the first step to making smart, impactful decisions. This section tackles some of the most common queries we hear, giving you clear answers so you can navigate the world of carbon offsets with confidence.

Let's clear up any confusion about the core ideas and practicalities, reinforcing what you need to know to take effective climate action.

What Is the Difference Between a Carbon Credit and a Carbon Offset?

It’s easy to get these two mixed up, but the distinction is important. Think of a carbon credit as the basic currency – a permit or certificate that represents the right to emit one tonne of CO₂ equivalent.

A carbon offset, on the other hand, is a specific type of carbon credit. It’s generated by a project that has proven it has either prevented one tonne of CO₂ from entering the atmosphere or actively pulled one tonne out.

When you buy a carbon offset, you're directly funding that specific project's work. To complete the process, that credit is then permanently "retired" in a public registry. This final step is crucial, as it ensures the credit can't be resold or double-counted, making your climate contribution unique and verifiable.

Can I Choose Which Specific Project My Money Supports?

Yes, absolutely. Most modern carbon offset marketplaces are set up like a detailed catalogue, giving you the chance to explore a wide range of projects from around the globe. This lets you select initiatives that truly resonate with your company's values or strategic goals.

You can usually filter your options by:

- Project Type: Do you want to back a reforestation effort, a wind farm, or a newer carbon capture technology?

- Geographical Location: You can choose to support climate action in a specific country or region that matters to your business or supply chain.

- Co-benefits: Many projects do more than just reduce carbon. They might also protect biodiversity, create jobs for local communities, or improve public health.

This transparency gives you the power to make sure your contribution supports the outcomes you care about, well beyond the simple carbon numbers.

Buying carbon offsets is a tool, not a get-out-of-jail-free card. The first and most critical step for any organisation is to measure and reduce its own emissions as much as possible. Offsetting should be reserved for the unavoidable emissions that remain after a robust internal reduction strategy has been implemented.

Is Buying Carbon Offsets Enough to Solve Climate Change?

No, and it's vital to be upfront about this. Offsets are a powerful tool, but they are designed to complement, not replace, the hard work of reducing your own emissions directly. Think of them as a way to take responsibility for the residual, hard-to-abate emissions that are left over after you've done everything you can to shrink your own carbon footprint.

The most credible climate strategies follow a clear hierarchy: first, you measure your emissions; then, you reduce everything you can at the source; and only then do you offset what you can't yet eliminate. Relying on offsets as a standalone fix without a genuine commitment to decarbonisation is rightly criticised as greenwashing.

Ready to move beyond spreadsheets and guesswork? Carbonpunk offers an AI-powered platform to automate your emissions tracking, reporting, and reduction strategy with over 95% accuracy. Take control of your carbon footprint today.